german tax calculator munich

Get 1051 back on average from your German tax return. This should be enough to get a clear picture about the impact taxes may have on your income depending on how much you.

Payslips Hi Res Stock Photography And Images Alamy

0049 0 89 248 83 03 51.

. The standard VAT rate in Germany is 19. It is a progressive tax ranging from 14 to 42. Heres Teleports overview of personal corporate and other taxation topics in Munich Germany.

Please note that this application is only a simplistic tool. Foreign tax paid may be credited against German tax that relates to the foreign income or may be deducted as a business. Income tax calculator for Germany.

State your gross annual salary and set your desired currency. Online Calculators for German Taxes. Calculate Germany VAT online.

Use our income tax calculator to calculate the tax burden resulting from your taxable income. Ever Wonder How Much You Will Have Left of Your Gross Income After All Taxes and Contributions. To calculate your monthly payments enter the loan amount loan term and interest rate into the calculator.

Updated on Tuesday 07th November 2017. Germanys refund rate ranges from 61 to 145 of purchase amount with a minimum purchase amount of 25 EUR per receipt. If you only have income as self employed from a trade or from a rental property you will get a more accurate result by using.

Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. To the income tax. Our Tax Calculator App helps you easily calculate your net wage by breaking down the German tax system into parts.

Annual income 25000 40000 80000 125000 200000. Our best tax advisory and consultancy firm in Munich specialises in assisting foreigners with their tax needs. Easily calculate various taxes payable in Germany.

1881 2005. It can also help you compare different loan options. Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of any double taxation treaties signed with your country of residence.

Arttic Innovation GmbH is a subsidiary of the PNO Group Arttic Innovation GmbH is based in Munich and is cooperatively associated with Arttic SAS and PNO Consultants GmbH. The more advanced the studies the higher the wage. The German Income Tax Calculator is designed to allow you to.

It starts at 1 and rises incrementally to 45. Completely online in English - no more tax forms. Tax Calculator in Germany Updated on Tuesday 07th November 2017 Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of any double taxation treaties signed with your country of residence.

Salary Before Tax your total earnings before any taxes have been deducted. Singles can earn 8130 EUR per year tax free. Calculate Germany VAT online.

Calculate the amount of the German Tax Credit for RD here. Also known as Gross Income. Married couples can double that sum.

However how much a company pays also. A minimum base salary for Software Developers DevOps QA and other tech professionals in Germany starts at 40000 per year. Tax Calculator in Germany.

Germany has one of the lowest minimum spending requirements at 25 EUR. As a working student you can earn a variable hourly wage between the minimum wage currently 935 Euro February 2020 and 20 Euro. Japanese Tax rates are.

The standard VAT rate in Germany is 19. The so-called rich tax Reichensteuer of 45. Specify your tax class where necessary.

The German tax system can be pretty complicated as the German tax system is progressive. Japan Tax shōhizei 消費税 consumption tax Calculator. Income more than 58597 euros gets taxed with the highest income tax rate of 42.

2022 2021 and earlier. After this sum every euro you earn will be taxed with a higher percentage. Reduced German VAT rate is 7.

In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis. It starts with 14 when you earn 8130 EUR plus 100 EUR. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions.

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income. The SteuerGo Gross Net Calculator lets you determine your net income. The calculator will then give you an estimate of the monthly payments and total interest payable.

Those who earn up to 450 euros a month retain the entire income. Youll then get a breakdown of your total tax liability and take-home pay. With many years of experience we are familiar with the ins and outs of the German tax system and can provide guidance on a range of topics from.

From a higher income onwards small deductions are made. German Wage Tax Calculator. If you need help with the application contact us.

Singles can earn 8130 EUR per year tax free. Good to know before you fill in the salary calculator Germany. German Wage Tax Calculator This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022.

Ad Easy German tax returns for expats. The German Annual Income Tax Calculator for the 2022. You need to be older than 18 and have permanent residence or long-term visa more than 3 months in a non-EU country to be eligible.

The rate of 42 the so-called Spitzensteuersatz in Germany applies to a taxable income above 57052 to 270500 for individuals. Annual gross income 34000. You can enter the gross wage as an annual or monthly figure.

Effective personal income tax rate. The maximum tax rate in Germany is 42 per cent. As a working student you can earn a variable hourly wage between the minimum wage currently 935 Euro February 2020 and 20 Euro.

This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll. Personal taxation in Munich. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022.

If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator. At the same time more leading roles like Software Architect Team Lead Tech Lead or. The mortgage calculator is a great tool to help you budget for your new home purchase.

This sum rises in 2014 to 8354 EUR.

Vat Refund 101 How To Get Money Back When Shopping In Europe How To Get Money Europe Travel Tips Europe

Amazon Com Brewer S Best German Oktoberfest Home Brewing Ingredient Kit Beer Brewing Starter Sets Home Kitchen

Stock Analysis With Calculator And Fountain Pen Ad Analysis Stock Calculator Pen Fountain Ad Stock Analysis Analysis Fountain Pen

German Tax Credit Calculator Forschungszulagengesetz

Payslips Hi Res Stock Photography And Images Alamy

Fx 9860giii Graphic Calculator School And Graphic Calculators Products Casio

German Tax Return Online Do It Yourself

Payslips Hi Res Stock Photography And Images Alamy

Payslips Hi Res Stock Photography And Images Alamy

German Tax Credit Calculator Forschungszulagengesetz

German Business Taxes For Businesses Self Employed Freelancers

Everything You Need To Know About Your German Tax Return In 2022

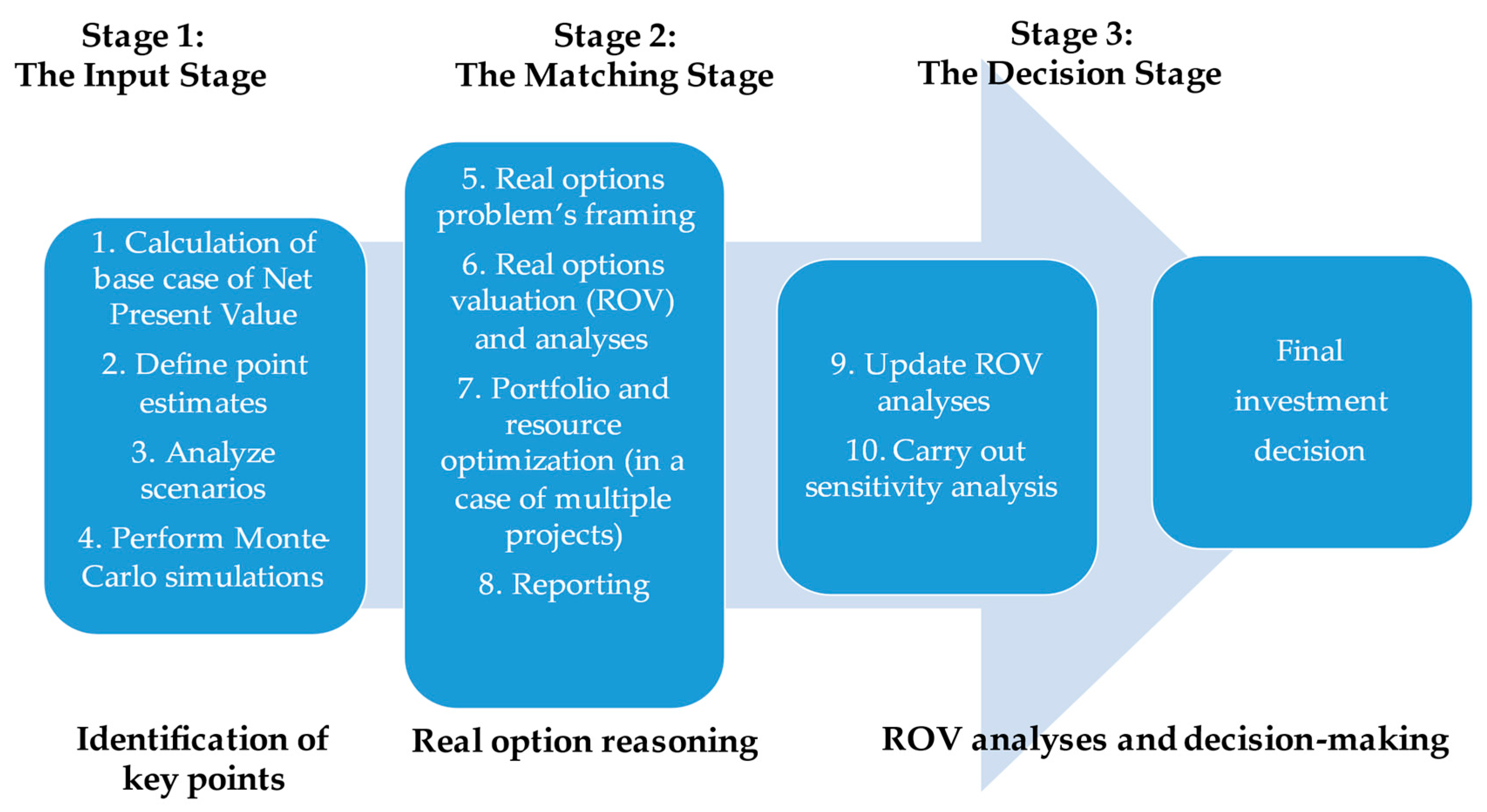

Jrfm Free Full Text Value Maximizing Decisions In The Real Estate Market Real Options Valuation Approach Html

German Payroll Example For 70000 70k Income Ta

Germany Individual Other Taxes

Refund Calculator Germany Pension Refund

Swiss Ramble On Twitter Fcbarcelona 269m Short Term Debt Is Easily The Highest Comprising 167m Bank Loans And 102m Transfer Fees Followed By Atleti 233m And Juventus 167m The Highest English Club Is

7 Must Know Facts About Bmw G310r Everything You Need To Know About The Next Big Thing By Bmw Tvs For The Indian Motorcycle M Street Motorcycle Bmw Motorcycle